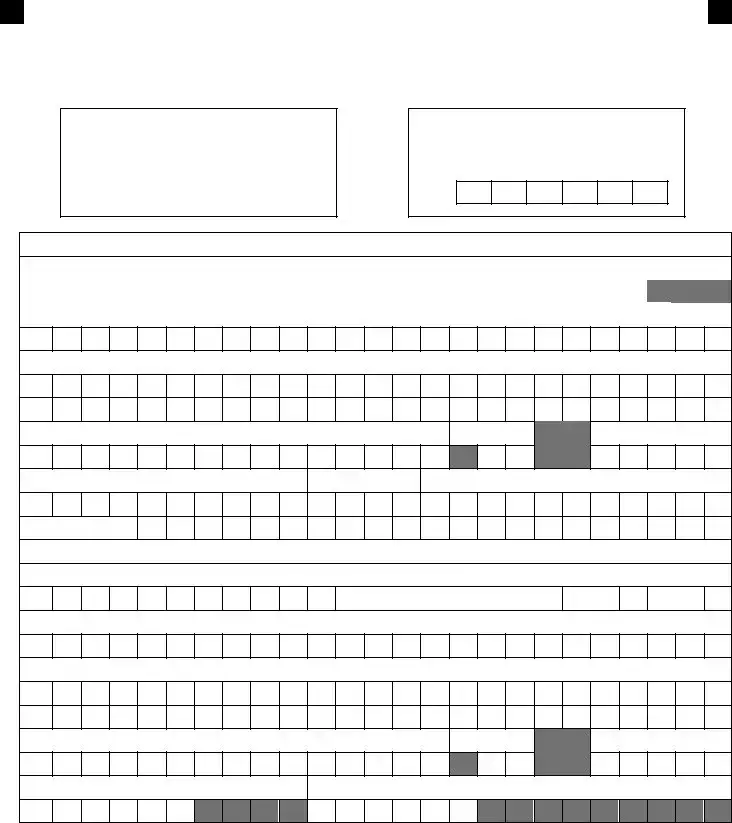

Fillable North Carolina Reporting Template

The North Carolina New Hire Reporting Form is a critical tool for compliance, mandated since October 1, 1997, aiming to assist employers in reporting new, rehired, or returning employees. This requirement ensures that necessary employee information is submitted either through the specified form, an IRS W-4 form with additional details, or electronically via magnetic tape or floppy diskette. It's essential for employers to send completed forms to the designated address, with strict adherence to the guidelines for filling out the forms, to avoid any penalties for non-compliance.

Make My Form Now

Fillable North Carolina Reporting Template

Make My Form Now

Make My Form Now

or

↓ North Carolina Reporting

This form deserves a proper finish

Complete North Carolina Reporting online quickly and easily.